This is Episode #4 in a deep dive on con artist Charlie Javice, the Forbes 30 Under 30 "business leader" who raked in millions from investors for her phony fintech startup Frank while scamming customers and leaving behind a trail of missed red flags.

Watch the series

Episode #1: Charlie's shady "nonprofit" lands her a reality show

Episode #2: Charlie launches the most hypocritical startup ever

Episode #3: Charlie cons JPMorgan into buying a list of fake emails

Episode #4: Charlie claims she’s the victim and sues JPMorgan

Episode #5: Judge forces JPMorgan to pay Charlie’s legal bills

—————

JPMorgan says Charlie made up millions of users.

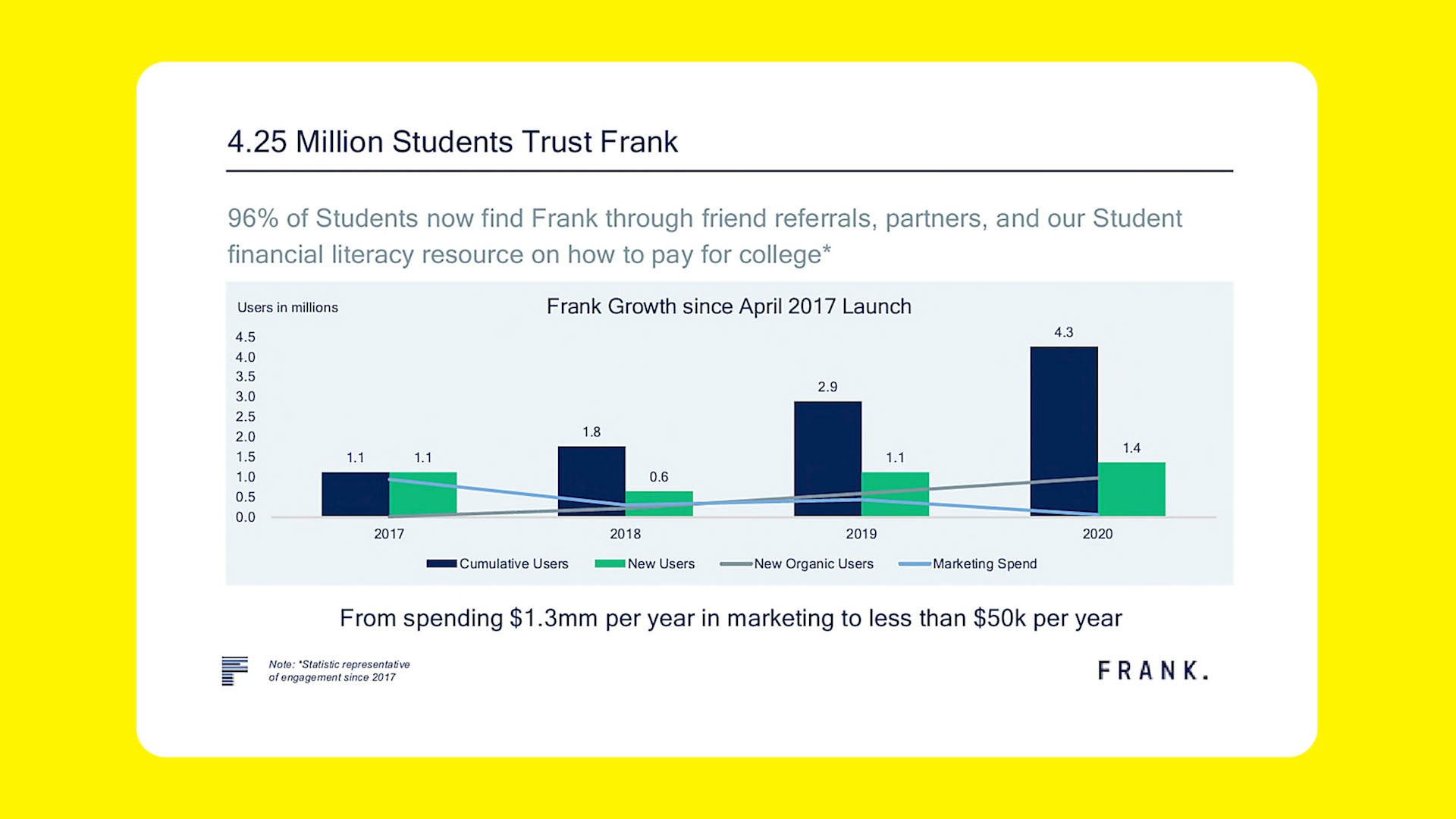

The bank claims Charlie’s company Frank repeatedly represented that it had 4.25 million users, filing multiple exhibits with the court to support this point, including the pitch slide below.

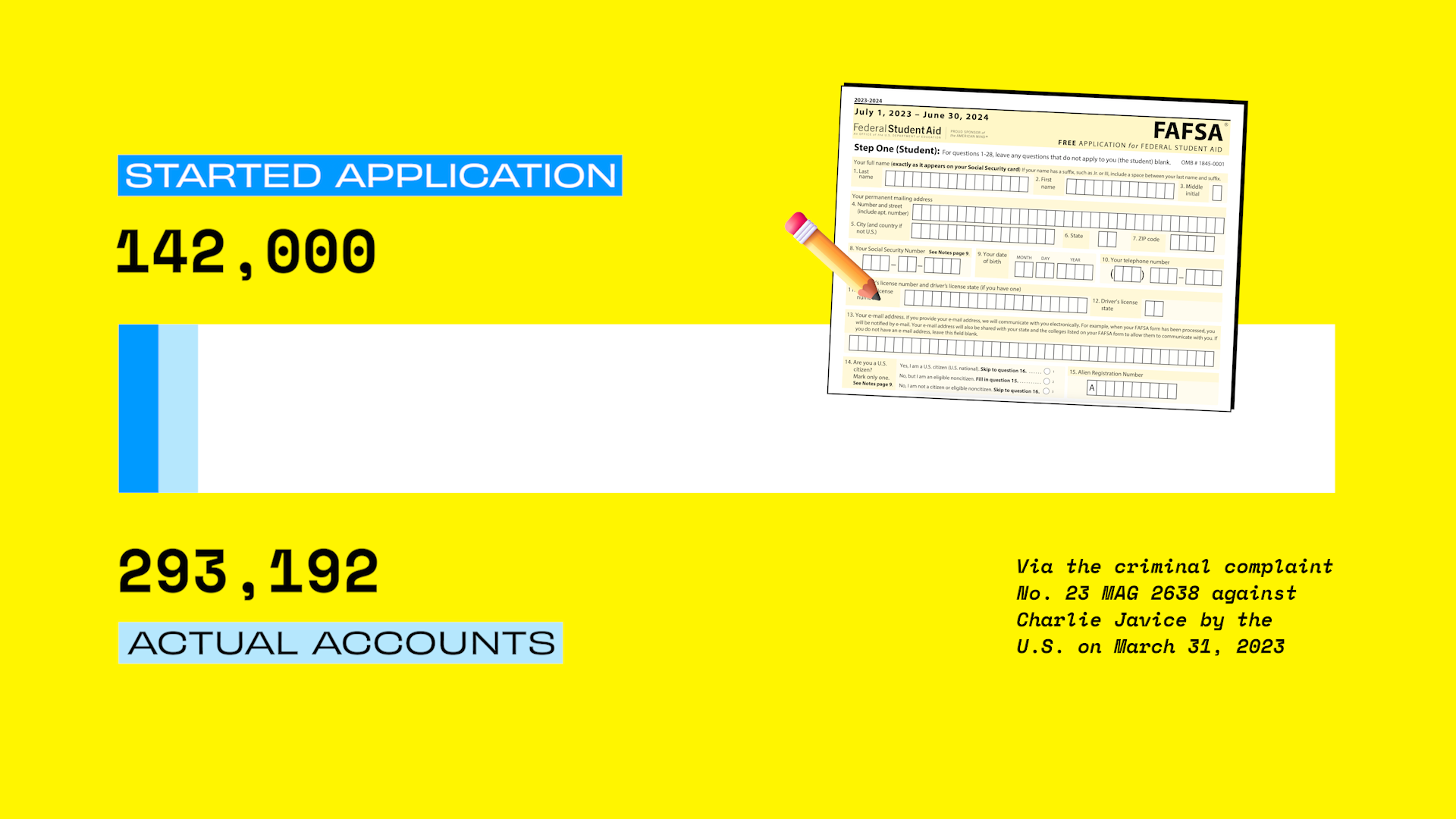

But a Slack conversation between Charlie and a Frank engineer revealed that the company had nowhere near 4.25 million registered users, according to a court filing by the Department of Justice. In the Slack exchange, the engineer told Charlie that fewer than 300,000 people had signed up on Frank’s website for an account, which was required to use its tool for FAFSA, or the Federal Application For Student Aid.

Despite this, Charlie’s attorney argues that she never lied when she said Frank had 4.25 million users, because her definition of “users” included not only registered account holders, but website visitors as well.

This made complete sense, he says, because a key driver of Frank’s value was not only its FAFSA tool, but its role as a trusted content provider attracting a coveted audience of diverse students.

JPMorgan Chase rejects this argument, though, pointing to a due-diligence spreadsheet in which Charlie Javice answers that Frank has more than 4 million “UNIQUE customer accounts” — a document that the bank says clearly indicates Charlie did not mean mere website visitors when spouting off that 4.25 million number.

Via a court filing by the Department of Justice

—————

Charlie says JPMorgan's valuation of Frank proves the bank knew how many users it had.

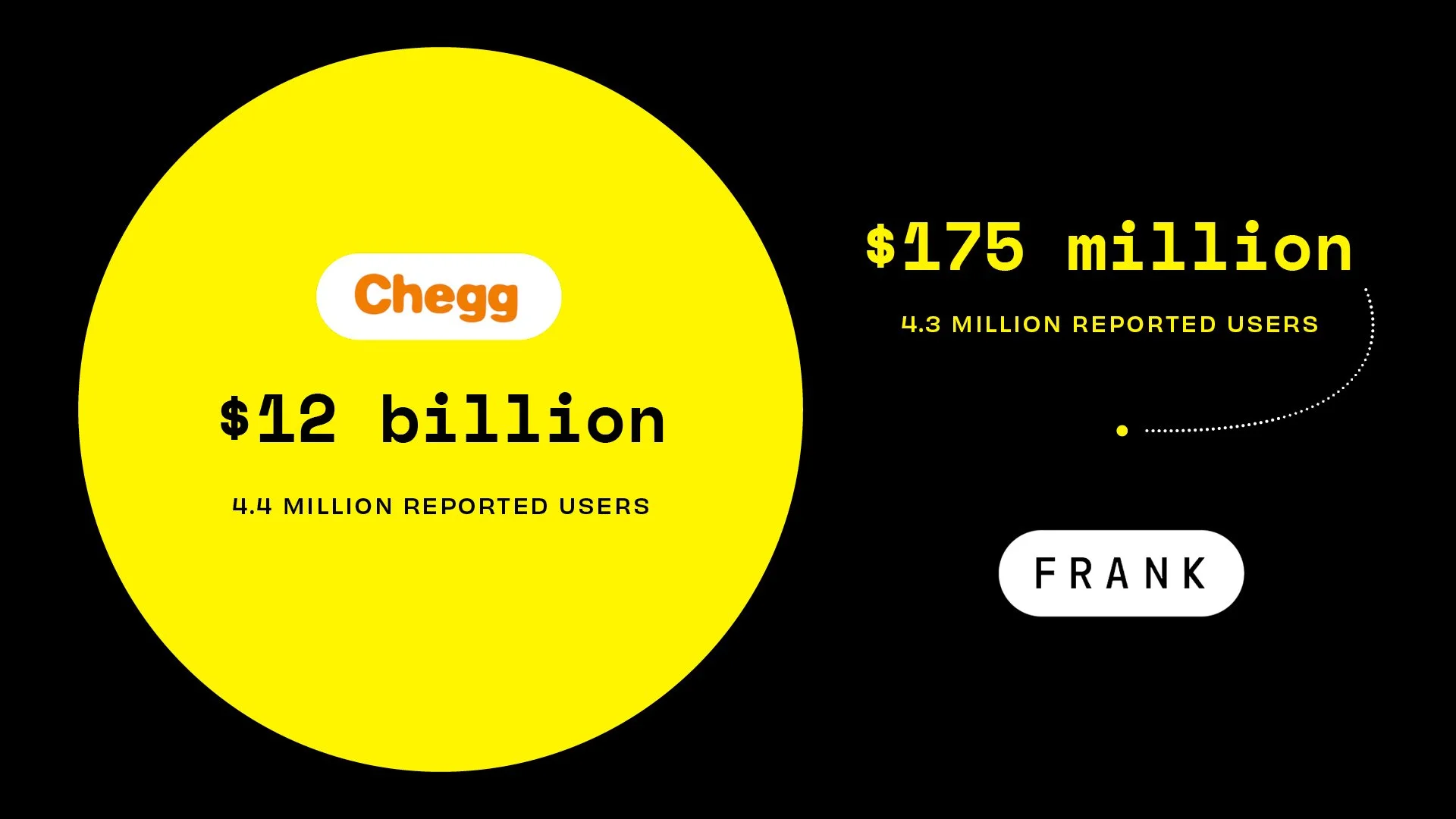

JPMorgan Chase purchased Charlie’s startup Frank for $175 million, but that’s far below the market value for a company with such a giant user base, Charlie’s attorney argues.

For example, Chegg, another company serving college students, reported close to the same number of users that Frank said it had — a little over 4 million — around the time that JPMorgan Chase bought Frank.

And yet Chegg was worth around $12 billion at the time, which is exponentially higher than the price JPMorgan Chase paid for Frank.

—————

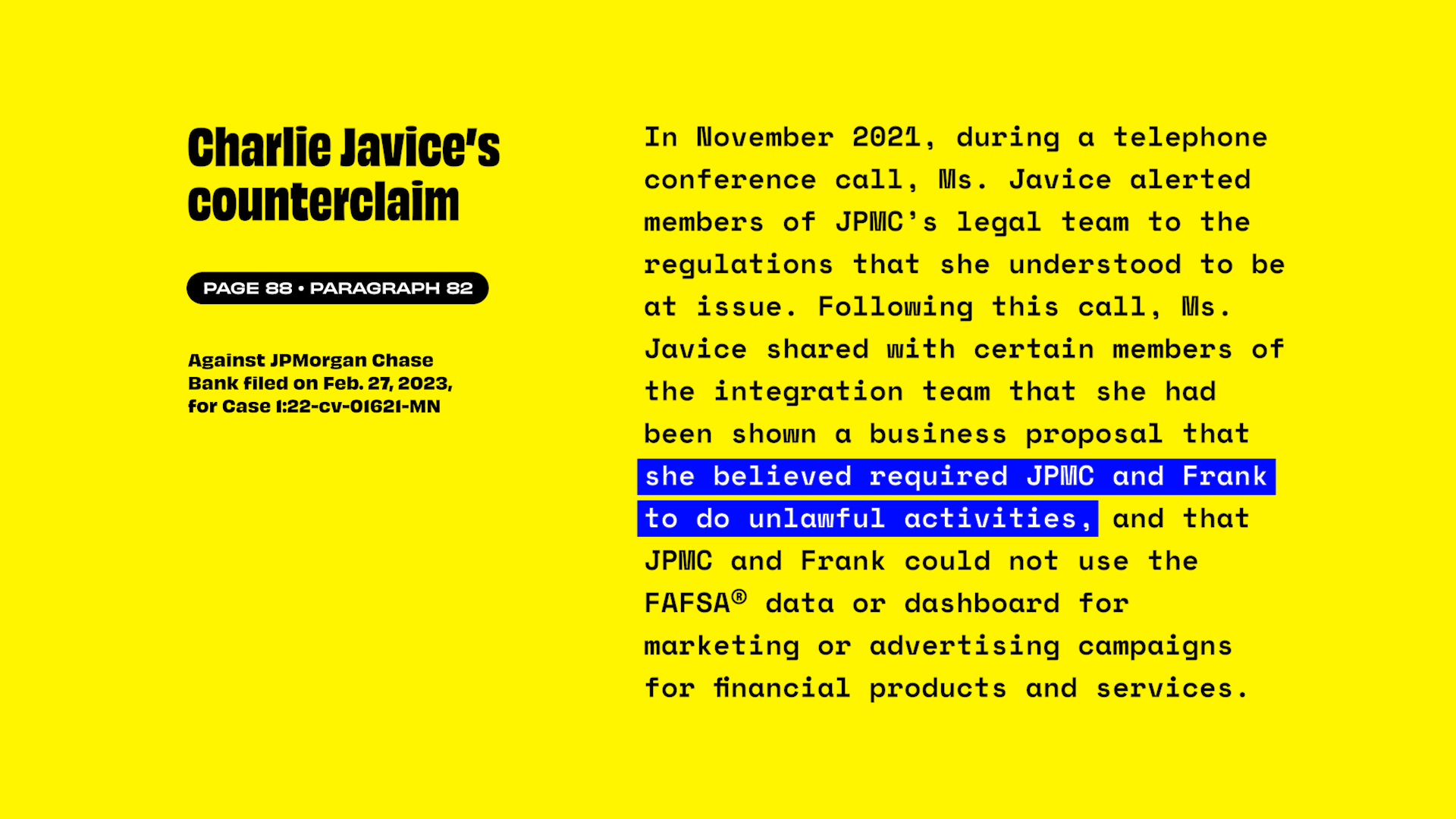

Charlie claims JPMorgan is suing her to cover up its own dirty deeds.

Charlie’s attorney says her bosses at the bank wrongfully retaliated against her after she blew the whistle on them. He says Charlie believed her superiors planned to violate privacy laws by using sensitive student data obtained through federal financial-aid applications to market Chase’s financial products.

But JPMorgan counters that Frank explicitly pitched itself to potential investors as a sales machine for banking products, boasting about the streamlined onboarding process it offered thanks to the valuable data entered into its FAFSA tool.

To see more inside evidence from this case, watch the full episode on YouTube.

CFPB Takes Action Against Wells Fargo and JPMorgan Chase for Illegal Mortgage Kickbacks via CFPB

Chase Card Services renews Acxiom marketing deal via Finextra'

Chegg’s Q3 2021 financial report via Chegg Investor Relations

Chegg’s historical market-cap data via macrotrends

College Enrollment & Student Demographic Statistics via EducationData.org

Court complaint filed by Charlie Javice against JPMorgan Chase for advancement via Fortune

Court exhibits, descriptions and a brief filed by JPMorgan Chase showing internal Slack messages at Frank, Frank’s pitch deck, emails by Charlie preparing for investor meetings, and JPMorgan Chase’s alleged notes during pre-acquisition due diligence with Frank

Court exhibits filed by JPMorgan Chase showing Charlie Javice’s employment agreement with JPMorgan Chase

Court exhibits filed by JPMorgan Chase showing its termination letter to Charlie Javice

Court records for JPMorgan Chase’s civil case against Charlie Javice via CourtListener including JPMC’s complaint and Charlie’s counterclaim

Court records for the U.S. Department of Justice’s criminal case against Charlie Javice via CourtListener including the DOJ's complaint

Court records for the U.S. Securities and Exchange Commission’s criminal case against Charlie Javice via CourtListener including the SEC’s amended complaint

Frank’s FAQs page via Wayback Machine

How did JPMorgan fall for Frank? via Fortune

Jamie Dimon’s Letter to Shareholders in JPMorgan Chase’s 2020 annual report via JPMorgan Chase

JPMorgan Admits to Widespread Recordkeeping Failures and Agrees to Pay $125 Million Penalty to Resolve SEC Charges via SEC

JPMorgan agrees $13 billion settlement with U.S. over bad mortgages via Reuters

JPMorgan Chase admits to US market manipulation via The Guardian

JPMorgan Chase Admits that it Covered Up the Madoff Ponzi Scheme via Pomerantz Law

JPMorgan Chase Bank Wrongly Charged 170,000 Customers Overdraft Fees via ProPublica

JPMorgan Chase Q4 2022 earnings call transcript in which Jamie Dimon asked about his company's financial discipline via The Motley Fool on Wayback Machine

JPMorgan fined $136M for debt collection practices via CBS News

JPMorgan hit with $200 million in fines for letting employees use WhatsApp to evade regulators’ reach via CNBC

JPMorgan “ignored Bernard Madoff red flags” via The Telegraph

JPMorgan's Jamie Dimon misled investors, dodged regulator to hide 'monstrous' derivatives bet that went bad via Financial Post

JPMorgan Pulled $275 Million Of Its Own Money From Madoff Feeder Funds Months Before His Arrest via Business Insider

Redditors express skepticism about Frank’s FAFSA tool via Reddit

Synthetic data overview and insights via JPMorgan Chase

U.S. Department of Education announces update requiring 2-factor authentication via Federal Student Aid

—————

About Guzzle

Hi! I'm Mary, and I make Guzzle, a YouTube series that spills the tea on shady money-makers. I investigate scammers, report on suspicious tactics, and try to help y'all avoid financial harm. The full story →